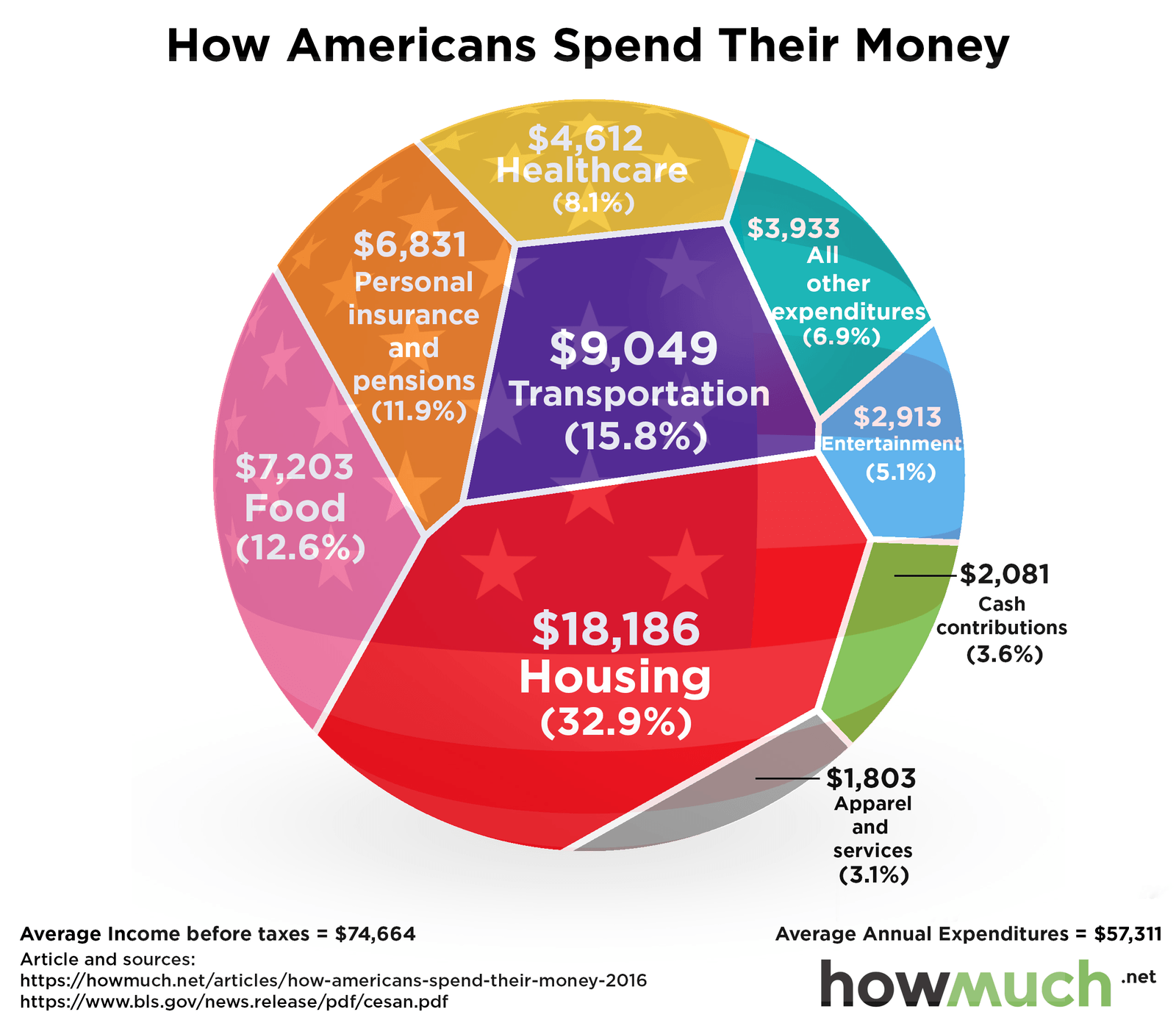

That said, salaries also may be lower and job opportunities less broad in regions where it's less expensive to live. For example, the cost of living in New York City far exceeds the cost of living in Cleveland, Ohio.Īmericans in less expensive places may be able to boost their average savings because they typically spend less monthly, while it may be more of a challenge to save in places that have a higher cost of living. The spending power of a household’s earnings largely depends on regionality, or where people live. The figure reflects income before taxes, meaning that the average monthly take-home pay is less after taxes.

The average consumer unit income was $84,352 in 2020, or $7,029 monthly, according to the study. The following data from the 2020 Bureau of Labor Statistics survey will allow you to assess how your spending compares with the average household. The survey breaks down income and expenditures on essentials, such as food and shelter, as well as discretionary spending on apparel, food away from home and other monthly bills, by consumer unit. The study reflects what the BLS refers to as “consumer units,” which are essentially households of either related family members or roommates. The most recent survey was conducted from January to December 2020 and released in September 2021. The BLS conducts an annual Consumer Expenditure Survey to better understand personal finance on a household level. Read on to learn more about the typical monthly expenses for Americans, how the costs break down and how your spending compares. However, this latest figure is from 2020, and given the inflation situation, this figure has likely increased over the past two years. The added spending may even affect people's average net worth as they're less able to save for down payments on homes, retirement and other financial goals.Īccording to the Bureau of Labor Statistics (BLS), the average household spends $5,111 each month on housing and other monthly expenses. This increase in cost of living may result in a spike in monthly spending for many American households. In fact, over the last 12 months, consumer prices - a broad measure of inflation - rose to 9.1%, which is the biggest increase in four decades. The continued impact of the pandemic, including labor shortages and supply chain disruptions, has increased the cost of food, housing, fuel and more. The cost of living is going up - and so are Americans’ monthly expenses. Inflation is causing prices to rise across budget categories.Housing, transportation and healthcare costs are some of the top expenses.The average American household spends $5,111 each month.

0 kommentar(er)

0 kommentar(er)